HOME > CASE STUDIES

Case Study 1 – Creating Value When it is Time to Sell a Family Business

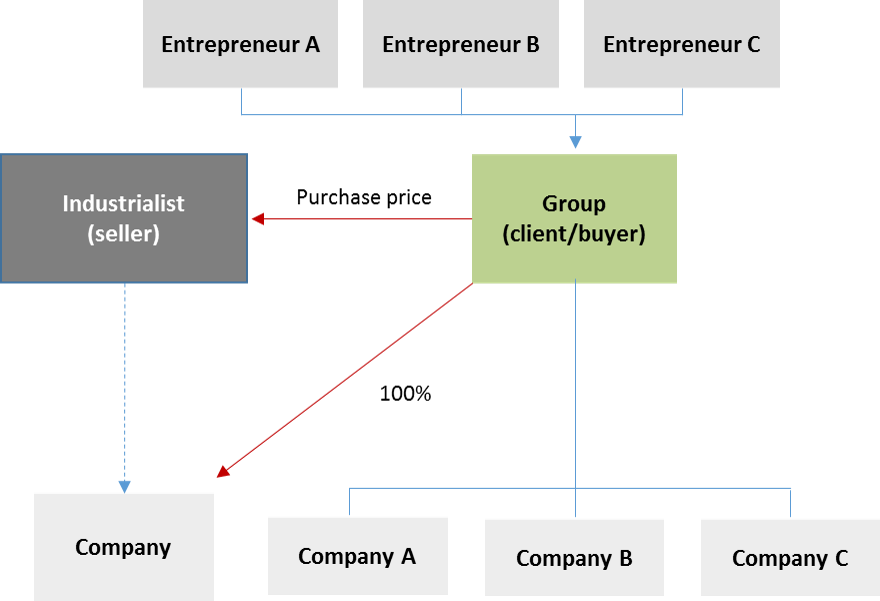

- An industrialist owned 100% of a Swiss company founded in the late 1870s and operating in the watch industry as sub-contractor.

- With retirement age approaching, the industrialist needed to decide on the company’s future. His son was involved in the operations, but was not eager to take over the business.

- The industrialist and his advisor met VRC. The industrialist explained that he wished to sell the Company to a buyer sharing his vision.

- Using its proprietary network VRC rapidly identified some entrepreneurs leading a Group active in the luxury industry.

- The Group appointed VRC as its exclusive advisor in connection with the contemplated purchase.

- VRC advised the Group on the acquisition and how to integrate the seller’s organization into the existing Group.

- Post transaction, the industrialist remained active in the Group, taking on several board positions.

The size of this transaction was CHF 20 million

Case Study 2 – Creating Value for a Family Through Mergers and Acquisitions

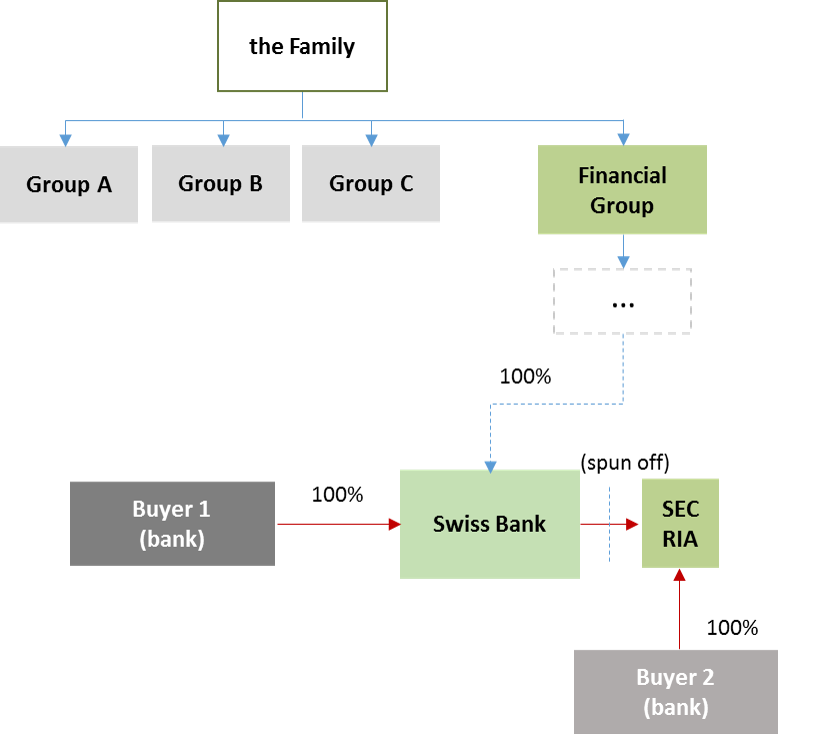

- The Client was a North American family, which controlled a multi-industry conglomerate with worldwide activities.

- The Client decided to restructure and divest its Swiss private banking operations (Swiss bank).

- The Client retained VRC as their exclusive advisor to identify a strategic buyer and carry out the transaction.

- VRC used its relationships to identify and to contact 10 potential strategic buyers.

- Working with the Client, a decision was taken to focus on three potential acquirers.

- VRC supported the Client throughout the negotiations, it organized and worked with the acquirers throughout the due diligence process and worked with the Client on the development of final contractual terms.

- The Swiss bank was successfully merged with the private banking activities of the Buyer. The Buyer is now one of the leading wealth managers in its geographical market.

- Subsequently, the Client again retained VRC for the divestment of a SEC Registered Investment Advisor (RIA), which was successfully spun off from the Swiss bank and acquired by a large international banking group.

The combined value of these two M&A transactions was CHF 130 million

Case Study 3 – Creating Value for Private Investors Where ValleyRoad Capital Contributes its Own Capital

- VRC identified complementary technologies and determined that such technologies had the potential to be profitably combined into a unique, world-class industrial recycling process.

- VRC secured the rights to the existing Intellectual Property and contributed these to a new Swiss Company (“SwissCo”).

- A “series A” funding round was rapidly raised with private investors. The goal was to develop a working lab scale pilot process using the combined technologies.

- Leveraging the know-how of its Managing Partners, VRC organized the hiring of highly specialized technical consultants and oversaw the management of the pilot project.

- 9 months later, having successfully demonstrated that the process was effective at lab scale, VRC proceeded to successfully raise a “series B” funding round with existing and new investors in order to take the underlying technologies to the pre-industrialization stage as well as to initiate SwissCo’s commercial development.

- SwissCo has now raised its “series C” funding round enabling full scale industrialization of the technologies and process.

Series C pre-money valuation at more than three times the Series A value. Total funds raised to date CHF 7 million

![1[1]](https://valleyroadcapital.com/wp-content/uploads/2016/04/11.png)

Case Study 4 – Structuring and Managing a Complex Asset Sale

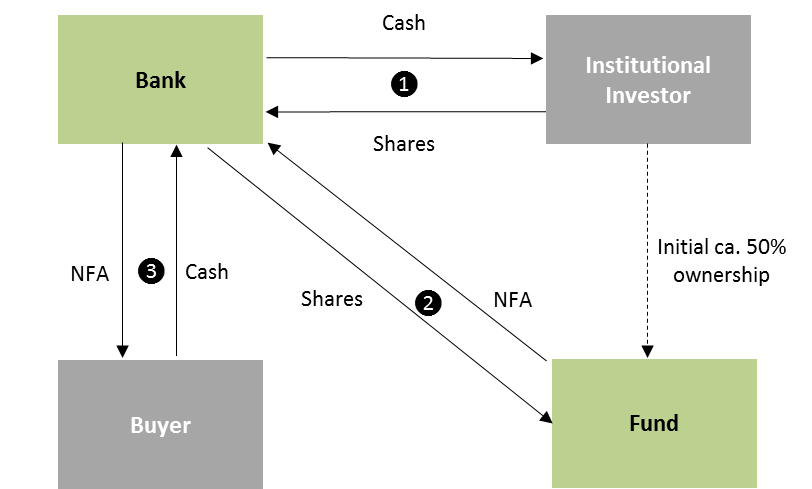

- VRC was approached by a European Fund owning substantial investments in non-financial assets (NFA) and needing to create liquidity for a very large Institutional Investor.

- VRC identified a Bank who would be willing to acquire the Fund’s shares for their own account. VRC led the negotiations for the Bank with the Fund and successfully purchased of the shares from the Institutional Investor at a substantial discount to NAV.

- The bank then redeemed their fund shares for the underlying NFA.

- VRC was instrumental in getting the regulatory approval for the redemption in-kind by the Bank.

- Lastly, VRC identified an Asian investor to whom the Bank’s NFA were sold at a substantial profit.

The size of this transaction was EUR 35 million

Case Study 5 – Creating Shareholder Value through the Leveraged Management Buy-Out (MBO) of a Family-Owned Business

- The Client was a world leading North American family-owned service business, highly profitable, strongly cash generative and growing.

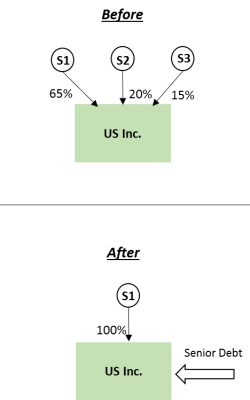

- The Client was owned by three shareholders, two of which owned a minority stake and had decided to retire.

- The majority shareholder did not wish exit the business at that time.

- The shareholders sought VRC’s advice on how best to achieve their individual (and conflicting) goals.

- VRC advised on and organized a debt recapitalization of the Client. The debt recapitalization allowed the firm to purchase the shares owned by the minorities. These shares were subsequently cancelled and the majority shareholder became the 100% owner of the Client.

- In the course of its advisory mandate, VRC identified suitable potential lenders. VRC assisted the Client in selecting the preferred lender and worked with the Client to negotiate the terms and conditions of the senior debt.

The enterprise value of the MBO transaction was USD 100 million